Cost of Living in UK: A Comprehensive Guide

8 min read

Updated On

-

Copy link

Want to know the Cost of Living in UK? Delve into the comprehensive guide which would include the budgeting tips, average cost of living in UK for students, families, and individuals while planning finances effectively.

Table of Contents

Limited-Time Offer : Access a FREE 10-Day IELTS Study Plan!

The UK is one of the popular choices of destination for any individuals who want to find better opportunities, advance their academic skills, or improve their way of living. However, the Cost of Living in UK varies depending on factors such as location, lifestyle, and family size. On average, a single person can expect to spend between £800 and £1,200 per month, excluding rent. Therefore, you must be aware of the amount needed to sustain in the UK so that you can plan accordingly and focus on budgeting based on your needs.

Moving to the United Kingdom (UK) presents exciting opportunities, but understanding the cost of living is crucial for effective budgeting. In this detailed guide, we’ll explore various aspects of the average cost of living in UK including London, providing valuable insights and practical tips to help you plan your finances wisely.

Let's dive into understanding the Cost of Living in UK: A Comprehensive Guide!

Average Cost of Living in UK: A Comprehensive Guide

Whether you are planning to move to London, Edinburgh, Manchester or want to settle in Bath or York, knowing the cost of living is important for planning and decision making. Understanding the average cost would provide you with an opportunity to plan and decide where you would want to stay, how would you travel, and many more basic needs. Let’s explore all aspects of housing, tuition, transportation, and other expenses so that you can make informed decisions.

1 Housing Costs

- Renting a one-bedroom apartment in London city center: £1,500 – £2,500 per month

- Renting a one-bedroom apartment outside of city center: £1,000 – £1,800 per month

- Average monthly mortgage payment for a 3-bedroom house: £1,200 – £2,000 per month

2 Transportation Cost

- Monthly public transportation pass (e.g., Oyster card in London): £100 – £200 per month

- Average monthly cost of running a small car (fuel, insurance, maintenance): £200 – £400 per month

3 Food and Groceries

- Monthly grocery bill for a single person: £150 – £300 per month

- Average cost of a meal at a mid-range restaurant: £10 – £20 per person

4 Healthcare

- Cost of private health insurance for a single adult: £50 – £150 per month

- Average cost of a dental check-up (without insurance): £20 – £50

- Prescription medication co-pay: £8.60 per item

5 Utilities

- Monthly electricity bill for a 2-bedroom apartment: £50 – £100 per month

- Monthly gas bill for heating and cooking: £30 – £60 per month

- Monthly water bill: £20 – £40 per month

- Monthly internet bill: £20 – £40 per month

6 Education

- Preschool or kindergarten in London average annual cost: £7,160.

- Private schools in the UK average annual tuition fee: £15,250.

- When considering higher education, international students can expect tuition fees ranging: £10,000 to £40,600 annually.

7 Entertainment and Leisure

- Average cost of a movie ticket: £8 – £15

- Monthly gym membership: £20 – £50 per month

- Cost of a theater ticket for a West End show: £30 – £100

Dive into the IELTS United Kingdom (UK) – UK Immigration | Study in UK and prepare yourself to move to the UK.

City-Wise Cost of Living in UK: A Comprehensive Guide

If you are planning to move to the United Kingdom, you will need to start with understanding income, expenses, and estimating budgets. The UK has many cities with state-of-the-art infrastructure which offers great public amenities, but the cost would differ depending on the region and an individual's lifestyle choices. Knowing the amount budgeted for the various expenses in a city is key to living comfortably. Let's dive into the different cities in the UK and their associated costs, providing valuable insights to help you plan your finances wisely based on your requirement.

1 Cost of Living in UK Cities Best for Students

If you are preparing to study for your undergraduate courses or enroll in a postgraduate program, understanding the cost of living is necessary. This would give you an overview of the average cost of living where one need to look at A Guide to Student Accommodation in the UK. The table below suggests the approximate cost of living in UK cities which are best for students.

| Expense Category | Manchester | Birmingham | Glasgow |

| Renting a One-Bedroom Apartment in City Center | £800 – £1,200 per month | £700 – £1,100 per month | £600 – £1,000 per month |

| Renting a One-Bedroom Apartment Outside of City Center | £600 – £900 per month | £550 – £900 per month | £450 – £800 per month |

| Average Monthly Mortgage Payment for a 3-Bedroom House | £900 – £1,500 per month | £800 – £1,300 per month | £700 – £1,200 per month |

2 Cost of Living in Cities Best for Families

Most families have a plan regarding the cost of living in UK, especially when they migrate or settle down in any particular area of the UK. Usually, people relocate due to job opportunities as well as the lifestyle in UK but they also consider the education facilities, healthcare, overall safety, and the quality of life. The table below suggests the cost of living in different cities which are best places for families to move in.

| Expense Category | Manchester | Birmingham | Cardiff |

| Renting a One-Bedroom Apartment in City Center | £800 – £1,200 per month | £700 – £1,100 per month | £650 – £1,000 per month |

| Renting a One-Bedroom Apartment Outside of City Center | £600 – £900 per month | £550 – £900 per month | £500 – £800 per month |

| Average Monthly Mortgage Payment for a 3-Bedroom House | £900 – £1,500 per month | £800 – £1,300 per month | £700 – £1,300 per month |

3 Cost of Living in Cities Best for Individuals

For individuals, finding the best UK cities which matches their preferences, personal life, finance, and career opportunities is an extremely impactful decision. The table below shows the cost of living in cities which are best for any individual who wants to move to the UK.

| Expense Category | Cost of Living in London | Cost of Living in Edinburgh | Cost of Living in Belfast |

| Renting a One-Bedroom Apartment in City Center | £1,500 – £2,500 per month | £800 – £1,300 per month | £550 – £900 per month |

| Renting a One-Bedroom Apartment Outside of City Center | £1,000 – £1,800 per month | £600 – £1,000 per month | £400 – £700 per month |

| Average Monthly Mortgage Payment for a 3-Bedroom House | £1,200 – £2,000 per month | £1,000 – £1,800 per month | £650 – £1,100 per month |

These costs provide a snapshot of the expenses associated with living in various cities across the UK, helping you make informed decisions about your relocation or accommodation choices based on your specific needs.

Boost your IELTS exam score with expert guidance—join our online webinar now!

Top 5 UK Universities and their Cost of Living in UK: A Comprehensive Guide

Affordability is also a major factor when identifying the right city to study while looking for well-ranked universities in the UK. If you are an international student, knowing the cost of living in UK is crucial, especially if a student is applying for the top UK universities. The education cost of education in UK involves understanding various factors such as tuition fees, living expenses, and potential additional costs. The table below will delve into these aspects to provide a comprehensive picture of what prospective students can expect when considering studying at top universities in the UK.

| Top UK Universities | Annual Tuition Fees | Accommodation | Other Living Expenses |

| University of Oxford | £9,250 – £15,000 (varies by program) | £6,000 – £12,000 per year (depending on location and type) | Approximately £8,000 – £10,000 per year |

| University of Cambridge | £9,250 – £15,000 (varies by program) | £6,000 – £12,000 per year (depending on location and type) | Approximately £8,000 – £10,000 per year |

| Imperial College London | £9,250 – £15,000 (varies by program) | £6,000 – £12,000 per year (depending on location and type) | Approximately £8,000 – £10,000 per year |

| London School of Economics and Political Science (LSE) | £9,250 – £15,000 (varies by program) | £6,000 – £12,000 per year (depending on location and type) | Approximately £8,000 – £10,000 per year |

| University of Manchester | £9,250 – £15,000 (varies by program) | £5,000 – £9,000 per year (depending on location and type) | Approximately £7,000 – £9,000 per year |

Prepare for IELTS with our personalized one-on-one expert classes and achieve your desired band score. Enroll Now!

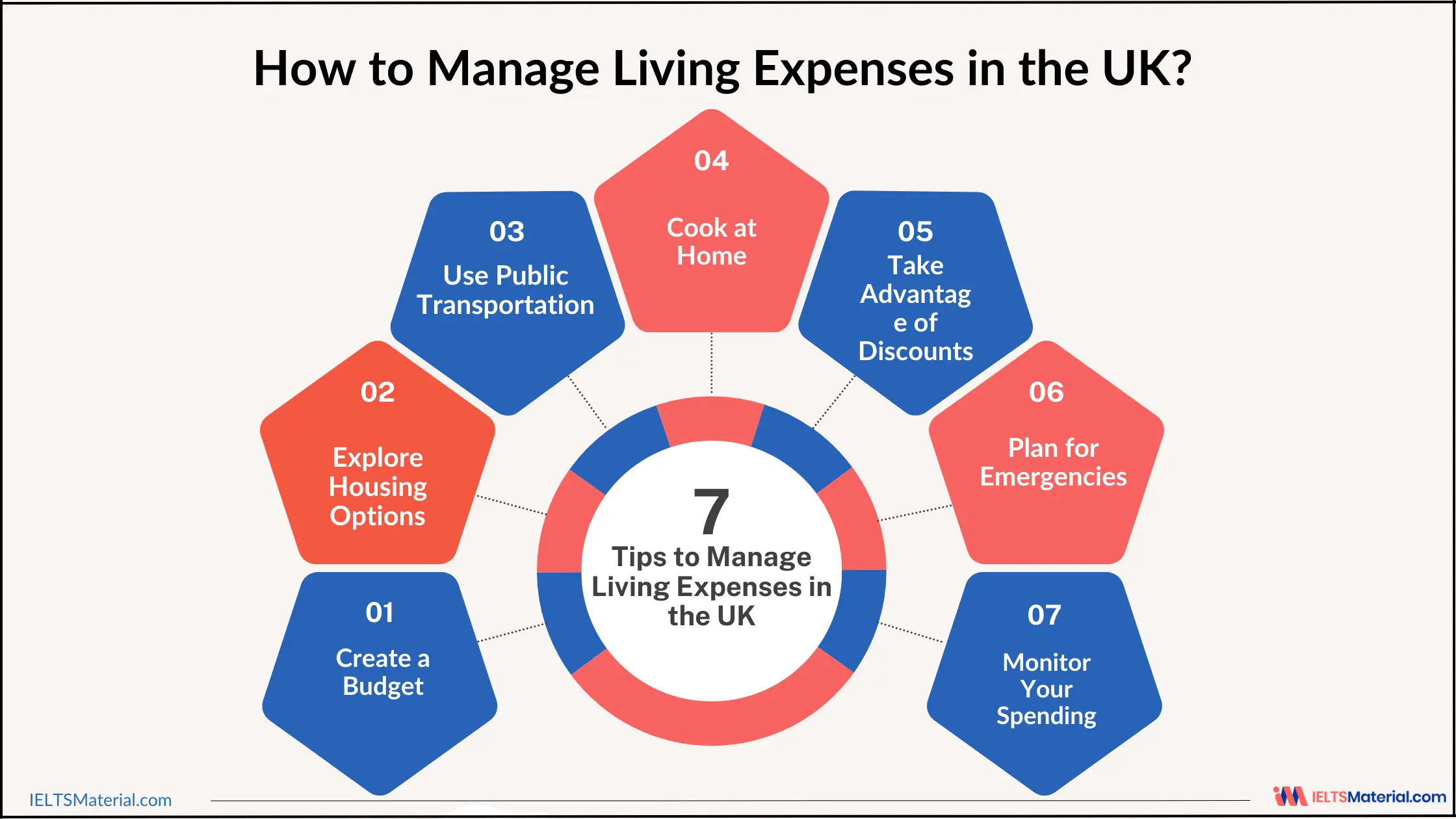

Strategies to Manage the Cost of Living in UK: A Comprehensive Guide

As there is a cost of living in UK, it is important for an individual to be familiar with it. However, there are strategies through which one can live a fulfilling life while tackling the expenses involved. Whether you are a student, an individual looking to move to the UK, or a working professional, you need to be aware of the financial pressures. Managing the cost of living in UK requires careful planning and budgeting. Here are some tips to help you effectively manage your finances.

- Create a Budget: Establish a monthly budget that outlines your income and expenses, including rent, utilities, groceries, transportation, and discretionary spending. Stick to your budget to avoid overspending.

- Explore Housing Options: Consider various housing options, such as renting a room, sharing accommodation with roommates, or living in more affordable areas outside major cities. Compare rental prices and amenities to find the best fit for your budget.

- Use Public Transportation: Take advantage of public transportation options, such as buses, trains, and trams, to save money on commuting costs. Consider purchasing weekly or monthly travel passes for additional savings.

- Cook at Home: Save money on food expenses by cooking meals at home and packing lunches for work or school. Shop for groceries strategically, taking advantage of discounts, bulk purchases, and seasonal produce.

- Take Advantage of Discounts: Look for discounts, deals, and loyalty programs offered by retailers, restaurants, and entertainment venues. Students, seniors, and NHS staff may qualify for special discounts on various products and services.

- Plan for Emergencies: Set aside a portion of your income for emergencies or unexpected expenses, such as car repairs, medical bills, or job loss. Building an emergency fund can provide financial security and peace of mind.

- Monitor Your Spending: Track your expenses regularly to identify areas where you can cut costs or make adjustments. Use budgeting apps or spreadsheets to monitor your spending habits and stay within your budgetary limits.

Check out the IELTS for UKVI General Training and take a step towards success!

Understanding the cost of living in UK is vital for sound financial planning, regardless of whether you’re a student, a professional, or a family moving to the country. By getting familiar with the valuable insights and practical strategies to manage your expenses effectively, you can make the most of your experience in this diverse and vibrant nation. However, remember to plan effectively in terms of the city and the expenses involved to explore the opportunities in UK.

Also Check :

- MBA in Canada for Indian Students in 2025: Types, Requirements, Top Colleges & Jobs

- Top Universities in Canada for Masters in 2025: Courses, Eligibility, Rankings

- Australia PR in 2025: Eligibility, Pathways & Cost for PR

- Top 20 Universities in UK which accepts IELTS Score for MBA

- IELTS Registration 2025: A Complete Guide

Frequently Asked Questions

What is the average cost of living in the UK?

What is the cost of living in UK for Indian students?

Which UK cities have a low cost of living?

How much does it cost to live in the UK for a family of four?

What is the average monthly cost of living in the UK for international students?

Are there affordable housing options for international students in the UK?

How much should I budget for miscellaneous expenses in the UK?

What is the cost of living in London?

What percentage of income should I allocate for rent in the UK?

Explore IELTS related articles

Start Preparing for IELTS: Get Your 10-Day Study Plan Today!

Recent Articles

Nehasri Ravishenbagam

Nehasri Ravishenbagam

Haniya Yashfeen

Post your Comments